Many of you, and we, are aware that AMC Entertainment has been on “The Threshold List” for 3+ weeks, indicating a number of FTD’s. Some of you may be pleased to learn that we have contacted both FINRA and the NYSE asking that they both look closely at the trading of our stock.

— Adam Aron (@CEOAdam) March 7, 2023

AA, I have figured out what they’re doing.

— AMC 2 Moon (@AMC_Apee) March 7, 2023

They FTD their FTDs that were FTD’d from previous FTDs, which were FTD’d from the FTDs at the beginning FTDs that were FTD’d in replace of the very first FTD’s then switched over to FTD’s in order to FTD their future FTDs$AMC

Look closely huh? Lol sorry this is how I see @NYSE and @FINRA looking at the stock 😂😂 they are going to look at it and say “ Yup, I see it… closely… looks fine…” pic.twitter.com/UNMiAXI6zW

— 🇺🇸Mi⚓️ke🏴☠️ (@mikegz83) March 8, 2023

We appreciate you and your willingness to listen to your shareholders! I truly mean it when I say #APESNEVERLEAVING pic.twitter.com/lGN4sNxKd5

— Steve Smith (@stevesmith0522) March 8, 2023

- AMC Entertainment is currently the most expensive stock to short, with borrow fees north of 140%. In February, these fees topped 700%.

- Bed Bath & Beyond is another very expensive stock to short, with fees around 116%.

- GameStop is also one of the most expensive stocks to short, and it remains popular with meme investors.

Gary Gensler, is in charge of the SEC. He is the man that wrote the checks that paid for the fake Steele Dossier through Hillary Clinton's campaign.

— Wendy Patterson (@wendyp4545) March 1, 2023

He created the money laundering avenue through the law firm to the bad actors of the Russia hoax.

Perter Strozk wife, Melissa… https://t.co/wozJ9lN491

Gary Gensler, Chairman of the Securities and Exchange Commission, was the treasurer for the Hillary Clinton campaign in 2016. He paid for the fake Steele dossier by laundering money through Perkins Coie.

— NEHogman (@CaptHogman) March 1, 2023

Let that sink in...

Market Makers sold 39,167,559 shares of $AMC which failed to deliver from Feb 1st - 15th

— Skyler Roundtree (@skylerroundtree) March 2, 2023

It landed the stock on something called: “Threshold Security List”

Regulation SHO Rule 204 governs security transactions which fail to deliver; and it’s not being followed: pic.twitter.com/VDvVuKrtxm

An argument should be made right before the SEC / Congress over the current security law being broken in regards to the Naked Shorting of US stocks.

— Skyler Roundtree (@skylerroundtree) March 2, 2023

Case study AMC: Reg SHO requires on Day 13, Short Positions to close out; and locate the shares to do so. But, here we are on Day… https://t.co/a7JDPriYhB pic.twitter.com/xNsI2qYgXr

The numbers don’t add up. Market Makers sell things they don’t own, and clear their failure to delivers through Total Return Swaps (like FTX) & Off exchange trading which isn’t reported.

— Skyler Roundtree (@skylerroundtree) March 2, 2023

Student Debt Relief wouldn’t be as much of an issue if Millennials had a fair market to… https://t.co/DzZwdf25c0

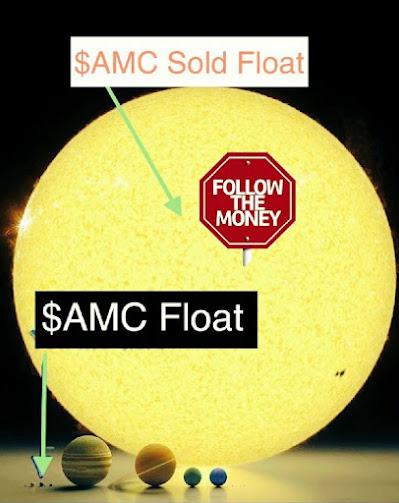

Feb 2nd - Feb 28th below, nearly the entire available public float was sold short. It’s amazing that a little ole’ movie theater stock has more failure to delivers than $TSLA, $AMZN, $GOOG, $MSFT combined.

— Skyler Roundtree (@skylerroundtree) March 2, 2023

Dark Pool trading makes this possible. Don’t care how long it takes, we… https://t.co/zXYgXLtnIq pic.twitter.com/EMegee4uR4

Shills would you BORROW rocks at 100+%? No, they’re worthless & easy to obtain

— AroundMyCitys (@AroundMyCitys) March 14, 2023

Why are SHF BORROWING shares of #AMC, a stock they deem worthless, at interest rate of 100+%

BORROW = Need to return

Are SHF BORROWING shares to dump on the market and scare retail ppl?$AMC $Ape https://t.co/IlHUZXWSId pic.twitter.com/5FKlPeXOfQ

Looking at Fidelity Orders currently:$AMC & $APE both among the Top Most Bought Stocks on the day, both with positive Buy Order vs Sell Order Ratios sitting at a 3:1 Ratio each, #APE having the 2nd highest ratio of any listed, #AMC having the 3rd highest.$GME #GME #ApesFTW pic.twitter.com/RAcIufRheO

— Alex (@AlexDaApe) March 14, 2023

$AMC has stayed on the Threshold List for 37 calendar days or 26 settlement days.

— MOASS_IN_YOASS 💎🙌🏽🦧✊🏽🌎🇭🇹🌙✨ (@JanJak_AMC) March 14, 2023

It disappeared on the 40th calendar day, 1 day b4 the vote on the RS-C with no justifying price action, just like it happened for the 43M+ #FTDs in #APE

Don’t worry. No manipulation in #AMC. pic.twitter.com/DEp8l2Hsvn

How did $AMC get taken off the securities threshold list? What changed?

— Wall Street Apes (@WallStreetApes) March 14, 2023

Today only 8.79% of $AMC volume traded on the NYSE. Today 75.14% of #AMC volume was processed off exchange/ dark pooled

75.14% DID NOT INFLUENCE AMC’s price. HOW TF IS THIS STILL GOING ON? #BanOffExchange pic.twitter.com/epmUSJOEtR

$AMC shareholders have approved the company’s proposal to convert AMC Preferred Equity, $APE, units into shares of common stock, per MarketWatch.

— unusual_whales (@unusual_whales) March 14, 2023

Proposal 1: APPROVED! $AMC

— 𒆜ℕ𝕚𝕔𝕜 G. - The Solar Guy (@goad_solar) March 14, 2023

Prop. 2: APPROVED! $APE -> $AMC

Proposal 3: NO LACK OF QUROM.

Preliminary count… (of those that voted below)

Proposal 1 - PASSED (88.0% FOR)

Common: 72.5% FOR

Pref.: 91.0% FOR

Proposal 2 - PASSED (87.3% FOR)

Common: 70.4% FOR

Pref.: 90.6% FOR pic.twitter.com/jNHU64qQYn

No comments:

Post a Comment