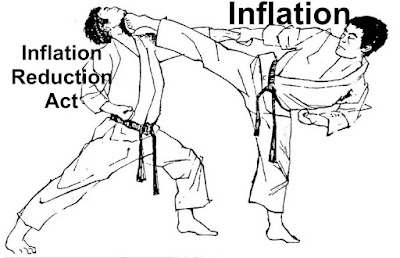

Bidenflation

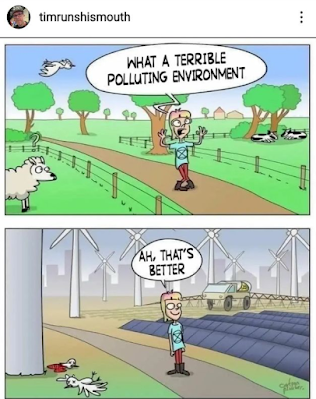

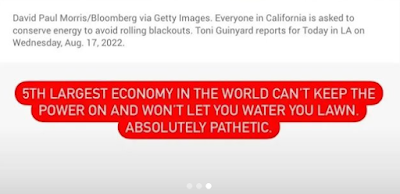

The Democrats are excited all of that tax payer money is being split among them. They see us as their tax paying working slaves they can use for their grandiose lifestyles. They keep increasing the federal national debt that we are forced to pay back by way of taxation. That's why the Democrats hired 87,000 new IRS agents to make sure they get paid to cover the debt they created. They're looting the US treasury for their personal gain. They don't give a shit about the environment. They're destroying the beautiful natural environment with their stupid Climate Change policies. (emphasis mine)Happy Inflation Reduction Act Day!

— Qondi (@QondiNtini) August 12, 2022

It’s done!!!

All 220 Democrats voted YEA

207 Republicans voted NAY

So far 4 Republicans NV

Speaker Pelosi is beaming and the House Democrats are cheering 👏🏿

They better take that victory lap! pic.twitter.com/xwGfSwfD6c

The Congressional Budget Office estimates those earning less than $400,000 will pay an estimated $20 billion more in taxes over the next decade as a result of the Biden Tax Hikes https://t.co/quy9ufSfIz

— RNC Research (@RNCResearch) August 15, 2022

With inflation raging near its highest level in four decades, Congress is poised to approve President Joe Biden’s signature Inflation Reduction Act. Its title raises a tantalizing question: Will the measure actually tame the price spikes that have inflicted hardships on American households? [Emphasis added]Economic analyses of the proposal suggest that the answer is likely no — not anytime soon, anyway. [Emphasis added]

The American IRS has a job posting for prospective special agents where you will need to carry a gun & be willing to kill. https://t.co/svmcb3fcfw pic.twitter.com/PVHkXv9BoH

— Andy Ngô 🏳️🌈 (@MrAndyNgo) August 10, 2022

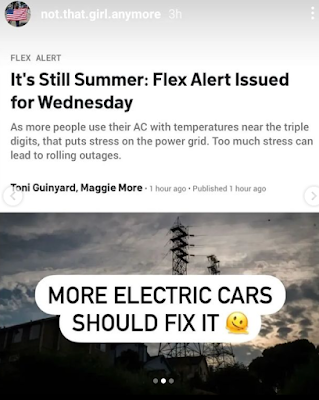

Sooo... the people who cried that instead of buying Twitter, Elon Musk could "solve world hunger" with $44 billion... are completely silent now that Democrats voted to spend $80 billion to expand the IRS... got it.

— Tim Young (@TimRunsHisMouth) August 10, 2022

Biden wants to send another $800 million to Ukraine... while hiring 87,000 new IRS agents to attack Americans.

— Tim Young (@TimRunsHisMouth) August 19, 2022

This administration legitimately hates our country.

Biden just sent another $775 million to Ukraine... so keep that in mind when one of the 87,000 new IRS agents who are authorized to used deadly force show up to your door to investigate whether or not you properly wrote off your birthday gifts on your taxes.

— Tim Young (@TimRunsHisMouth) August 19, 2022

New IRS agents are armed and trained to kill Americans... nothing to see here, everyone move along. https://t.co/chLLjmCNk3

— Tim Young (@TimRunsHisMouth) August 10, 2022

By 2030, 950 million solar panels, 120,000 wind turbines, and 2,300 battery plants will be powering homes, businesses, and communities all across America – thanks to the Inflation Reduction Act.

— The White House (@WhiteHouse) August 20, 2022

Amazing how fast the Inflation Reduction Act, pitched as indispensable to reducing inflation, flipped into a climate, environment and healthcare bill the moment after it passed. Almost magical politically-induced amnesia from the media on this one.

— Ben Shapiro (@benshapiro) August 16, 2022

Only 12% of Americans think the "Inflation Reduction Act" will reduce inflation.

— Julio Gonzalez - juliogonzalez.com (@TaxReformExpert) August 16, 2022

These are the same Americans who wear a mask alone in the car.

They don't give a shit about us or the environment. (emphasis mine)

No comments:

Post a Comment