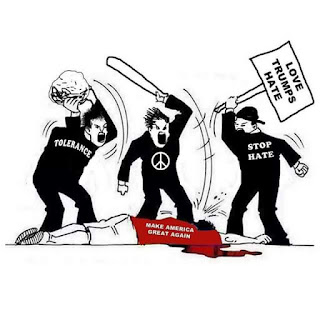

THIS IS WHAT AMERICANS WILL GET IF THEY VOTE FOR 4 MORE YEARS OF MARXISM with Hillary Clinton AFTER 8 YEARS OF Obama's Marxist failed economic policies. And don't tell me Venezuela is an exception. NAME ONE SUCCESSFUL Marxist Socialist Nation ON THIS PLANET throughout history. ANSWER: THERE IS NONE.

Venezuelans voted for Maduro simply because he supported the same damn failed policies his Marxist Socialist predecessor believed in. They didn't give a damn that the only real experience Maduro has ever had was driving a fricken bus and leading a labor union protest against his employer. Yeah, that makes sense. Let's vote for more of the same crap sandwich please. Because it tastes so damn good. NOT. :/ Now the Venezuelan people are living in hell and people, mainly Chavistas, still have THE NERVE to defend the Marxist Socialist inept government and blame the US for Venezuela's nightmare. Yeah. Okay. Whatever.

Venezuelans voted for Maduro simply because he supported the same damn failed policies his Marxist Socialist predecessor believed in. They didn't give a damn that the only real experience Maduro has ever had was driving a fricken bus and leading a labor union protest against his employer. Yeah, that makes sense. Let's vote for more of the same crap sandwich please. Because it tastes so damn good. NOT. :/ Now the Venezuelan people are living in hell and people, mainly Chavistas, still have THE NERVE to defend the Marxist Socialist inept government and blame the US for Venezuela's nightmare. Yeah. Okay. Whatever.

***********

Forbes.com, USA

written by Tim Worstall

Friday October 21, 2016

The stirring achievements of Bolivarian socialism as practiced in Venezuela never cease to amaze. They’ve managed to create, at one time, an entire country running out of beer. The banknotes cost more to print than they are worth. A fertile tropical nation has widespread food shortages. They’ve even managed that the place sitting on the world’s largest oil reserves has to import oil from the U.S. To add to this list of blows struck against the imperialist Yankees we can now add the possible bankruptcy, or at least default on its debts, of the monopoly oil company sitting on top of that ocean of oil which is the world’s largest reserves.

Venezuela’s state-owned oil company has warned that it is in danger of defaulting on its debts after investors declined an offer to swap bonds.Four times in the last month, Petróleos de Venezuela, S.A. (PDVSA) has extended an offer to investors to swap their bonds which mature next year for notes due in 2020. The oil company is required to pay out $1.8 billion this month and $3 billion next month in debt interest and bond maturities.This week, it warned investors in a statement that if they declined to swap their bonds, the company may end up defaulting.

Bankruptcy and default are not quite the same thing although one can lead to the other. Neither are evidence of great care or skill in managing this most important part of the Venezuelan economy.

The underlying reason here is in contention. Some lawmakers are shouting that it is corruption:

A report by a Venezuelan congressional commission accused Petroleos de Venezuela (PDVSA) [PDVSA.UL] of corruption on Wednesday, saying about $11 billion in funds went missing from the state-run oil company while Rafael Ramirez was at the helm from 2004-14.“It is more than the (annual) budget of five Central American countries,” said Freddy Guevara, comptroller commission president and a member of one of Venezuela’s hardline opposition parties, alleging widespread malfeasance at the state oil producer.“We’re talking about $11 billion they cannot justify,” he added, as he presented a report by the legislative body that audits the state.

Default would make matters problematic to say the least:

It’s likely the company will retain control of its assets such as the refineries in Venezuela, said Mara Roberts, a New York-based analyst at BMI Research. The story is different when it comes to oil being exported, she said.“Oil tankers could also potentially be at risk, with those carrying Venezuelan crude likely to face attachment claims upon arrival,” Roberts said by e-mail. “This could discourage take up of PDVSA’s shipments.”

My own explanation would be the more traditional one. The one common before these latest allegations of corruption. This is that Venezuela’s oil is very heavy and thus needs large capital investment for it to continue to be extracted. The basic operating method of the Chavez and then Maduro administrations has been to skimp on that capital spending and then spend the money saved on consumer imports into Venezuela. Largely as a means of buying political support despite their complete and total mismanagement of the domestic economy. There were also further borrowings using the oil company as the legal form doing the borrowing, again to fund such spending upon consumers.

But, obviously, borrowing spent on rice doesn’t increase the ability of the oil company to produce more oil to pay back the borrowings. Production, and thus income, has been falling, even without any influence of the falling oil price itself.

You can indeed buy bread and circuses with resource rents. But do too much of it and you’ll not have the capital to keep those resource rents coming. Which is what I would say has been another great success of boli socialism. And, obviously, one that we ourselves don’t want to repeat. Seriously, socialism, don’t do it.

No comments:

Post a Comment